Things are heating up in Alberta about the lack of a deal with the federal government on the billions available to support building a more comprehensive system of Early Childhood Education (this phrase matters) and child care in the province. Not only is the Minister of Children’s Services pushing out inflammatory tweets, but so are the Issues Managers (which I am told are called TheMatts). While I’ve been talking about ECE and child care for ages and ages, even before the pandemic, I caught the attention of the Jasons Kenneth and TheMatts last night. For those of you outside Alberta, TheMatts are sent out to discredit the reputation of the person tweeting facts they disagree with, not to actually discredit the facts. Yes, Alberta is a special place.

Let’s get into our TARDIS (don’t worry, it is bigger on the inside) and go back in time to Ottawa. The day is 23 September 2020. It is Speech From the Throne (SFT) day in Ottawa. Big day for anyone who follows policy. This is when the government of the day lays out its vision for the sitting. Usually these things spend a lot of time on what the government has already done and you have to really know your stuff to understand what is the new stuff. But this SFT had a section in it that made women across Canada sit up and pay attention. It is on page 13, and reads as following:

Women – and in particular low-income women – have been hit hardest by COVID-19. This crisis has been described as a she-cession.

Many women have bravely served on the frontlines of this crisis, in our communities or by shouldering the burden of unpaid care work at home.

We must not let the legacy of the pandemic be one of rolling back the clock on women’s participation in the workforce, nor one of backtracking on the social and political gains women and allies have fought so hard to secure.

The Government will create an Action Plan for Women in the Economy to help more women get back into the workforce and to ensure a feminist, intersectional response to this pandemic and recovery. This Plan will be guided by a task force of experts whose diverse voices will power a whole-of-government approach.

It has been nearly 50 years since the Royal Commission on the Status of Women outlined the necessity of child care services for women’s social and economic equality. We have long understood that Canada cannot succeed if half of the population is held back. Canadians need more accessible, affordable, inclusive, and high quality childcare.

Recognizing the urgency of this challenge, the Government will make a significant, long-term, sustained investment to create a Canada-wide early learning and childcare system.

The Government will build on previous investments, learn from the model that already exists in Quebec, and work with all provinces and territories to ensure that high-quality care is accessible to all.

There is broad consensus from all parts of society, including business and labour leaders, that the time is now.

The Government also remains committed to subsidizing before- and after-school program costs. With the way that this pandemic has affected parents and families, flexible care options for primary school children are more important than ever.

Here we have, in September 2020, the clear commitment to affordable, accessible, and high quality Early Childhood Education and child care that will be modeled after the program that already exists in Quebec.

Now let’s get back into our TARDIS and go forward in time to 20 November 2020. This is the date that the federal government tabled their Fall Economic Statement. Here we get even more details on pages iv-v and 76-79. This says

Investing in accessible, high-quality, affordable and inclusive child care is not only good for families, it makes good

economic sense. It gives children a good start in life and gives parents, especially mothers, the support they need to

maintain good jobs and provide for their families. In Quebec, where the provincial government has been investing

in high-quality accessible child care for over two decades, maternal labour force participation rates were 5 to 9

percentage points higher than in the rest of Canada in 2019. In particular, Quebec women with children under 3

have some of the highest employment rates in the world. Not only do good jobs help families individually, but

increased maternal labour force participation is good for economic growth and increases GDP per capita. Just as

Saskatchewan once showed Canada the way on health care and British Columbia showed Canada the way on

pricing pollution, Quebec can show us the way on child care.

There again, we have the commitment of a focus on affordable, accessible, high quality ECE and child care where Quebec shows us the way. It also notes that even further details will be laid out in Budget 2021.

Let’s get back into our TARDIS and go forward in time again to 19 April 2021. This is the day we got our budget. The commitment spans the pages of 97-105. Now a lot of details were in that budget and here they are below:

The federal government will work with provincial, territorial, and Indigenous partners to build a Canada-wide, community-based system of quality child care. This will be a transformative project on a scale with the work of previous generations of Canadians, who built a public school system and public health care. This is a legacy investment for today’s children who will not only benefit from, but also inherit this system.

Just as public school provides children with quality education in their neighbourhoods, the government’s goal is to ensure that all families have access to high-quality, affordable and flexible early learning and child care no matter

where they live. The government will also ensure that families in Canada are no longer burdened by high child care costs—with the goal of bringing fees for regulated child care down to $10 per day on average within the next five years. By the end of 2022, the government is aiming to achieve a 50 per cent reduction in average fees for regulated early learning and child care to make it more affordable for families. These targets would apply everywhere outside of Quebec, where prices are already affordable through its well-established system…

This once-in-a-generation transformation will take time and hard work from all orders of government—and that is why the next five years are focused on meaningful goals for families and setting the right foundations for success.

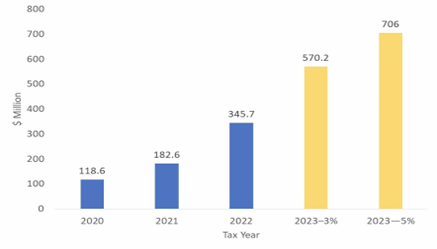

Up to $27.2 billion over five years, starting in 2021-22 will bring the federal government to a 50/50 share of child care costs with provincial and territorial governments, as part of initial 5-year agreements. Future objectives an distribution of funding, starting in year six, would be determined based on an understanding of need and progress achieved as part of this initial plan.

Over the next five years, the government will work with provinces and territories to make meaningful progress towards a system that works for families. The aforementioned federal funding would allow for:

A 50 per cent reduction in average fees for regulated early learning and child care in all provinces outside of Quebec, to be delivered before or by the end of 2022.

An average of $10 a day by 2025-26 for all regulated child care spaces in Canada.

Ongoing annual growth in quality affordable child care spaces across the country, building on the approximately 40,000 new spaces already created through previous federal investments.

Meaningful progress in improving and expanding before- and after-school care in order to provide more flexibility for working parents….

The next five years of the plan will also focus on building the right foundations for a community-based and truly Canada-wide system of child care. This includes:

Working with provinces and territories to support primarily not-for-profit sector child care providers to grow quality spaces across the country while ensuring that families in all licensed spaces benefit from more affordable child care.

A growing, qualified workforce—with provincial and territorial partners, the government will work to ensure that early childhood educators are at the heart of the system, by valuing their work and providing them with the training and development opportunities needed to support their growth and the growth of a quality system of child care. Over 95 per cent of child care workers are women, many of whom are making low wages, with a median wage of $19.20 per hour.

A strong basis for accountability to Canadians—the government will work with provincial and territorial partners to build a strong baseline of common, publicly available data on which to measure progress, report to Canadians,

and help continuously improve the system.

Quebec has been a pioneer of early learning and child care in Canada, with outcomes for children and families that have been studied around the world. However, the Quebec experience has also illustrated that building a system is

complex, and that phased and sustained investments are required to ensure that everyone has access to the same quality of care at affordable prices. These are valuable lessons for a pan-Canadian system. To build on the current

bilateral agreements:

Budget 2021 proposes to proceed with an asymmetrical agreement with the province of Quebec that will allow for further improvements to their system, which the people of Quebec are rightly proud of.

In addition, the federal government will authorize the transfer of 2021-22 funding as soon as bilateral agreements are reached with the provinces and territories, enabled by a proposed statutory appropriation.

So there you have it. The conditions on the federal funding AND that Quebec will get an asymmetrical agreement. So the fact that Alberta is not only complaining about the conditions AND that Quebec gets a very different agreement was laid out in the Budget in detail. If they are shocked by this, well, I can only assume that they did not read the Budget or they are being melodramatic solely for political reasons.

But let’s unpack this even more. What is the rationale for government intervention in the ECE market? The big one is because of the spill over benefits to society. That is the same reason we fully fund k-12 and partially fund post-secondary education. Neither of those seem controversial. The idea, however, that something magically happens at age 5 that woudn’t happen for a child aged 4.5 is, well, looney toons. We fund public education, and yes in Alberta we also provide the highest subsidies also for private education for the k-12 group, because society accrues nearly all the benefits from doing so. This really shouldn’t be controversial. In fact, the societal benefits are even larger in the under 5 crowed because that is when most of the really important brain development happens. There are also oodles of information failures in the ECE market. Some governments, like BC, have worked hard to overcome these failures, but Alberta has not. And of course another area of inefficiency is related to parents having to engage in constrained optimization that does not allow them to allocate their human capital to their most productive and economic efficient activity. In a nutshell, the market is inefficient and demands public intervention.

We can also look at the direct (and by direct I mean actual tangible benefits, not hokey impact analysis benefits) benefits that accrue to governments through increased tax revenues. In Quebec for every $1 in ECE spending they recouped $1.04 in revenues, the federal government recouped $1.40. This is from not only parents being able to engage in paid work, but also because of the employment benefits from expanding the sector.

Despite all this evidence, Alberta is kicking sand at the idea and it is doing so based purely on social conservative ideology. It is saying there is no flexibility. That is, in fact, false. Do the federal conditions require that spots being provided at $10/day as some in Alberta have claimed? No, the federal conditions are that the price be ON AVERAGE $10/day. Can they be $0 for some and $30 for others? Yes, yes they can. How might we decide how to do this? Well, the rule of thumb in the affordability literature, you know the same literature that has affordability for shelter being 35%, is that families should spend no more than 10% of their income on ECE and child care. So is there flexibility there? Yes!

Is the fee reduction that has to be rolled out 50% for everyone? No, it is ON AVERAGE a 50% fee reduction. Can there be private provision of child care? Yes, the federal government only wants a minimum of 50% of the focus being on the non-profit sector, well known for high quality and affordable ECE. And by the way, non-profit child care is not publicly provided union employed institutional child care (words the UCP throw about). In fact, there is no unionized, publicly provided child care in Alberta….at all.

Does the federal commitment mean that Alberta can’t invest in demand-side policies? No, it just means you can’t use these federal funds to do so. The federal government under this policy is intervening on the supply side of the market. The federal government too helps on the demand side. It has the Canada Child Care Expense Deduction (CCED). It could use some tweaks but there it is. It also has the Canada Child Benefit which provides direct, non-taxable income benefits to families. Alberta also has demand side policies. Want to continue with those? Go nuts. But I would like to point out the the current child care subsidy in Alberta is actually highly regressive and this is still true of the tweaks announced last week.

Alberta is also complaining that they were late to receive the term sheet from the federal government. I mean the terms were publicly known. See above. They should have been working on proposals since they knew the key terms already. But put yourself in the place of the federal government. It had several jurisdictions ready to go on deals: BC, Yukon, PEI, NS, NL, and Quebec. Alberta though when the budget came out went whole hog on expressing condemnation for the federal plan. So if I were allocating my scarce negotiating resources, I too would focus on those deals I can get done quickly and use that to add pressure to the hold out provinces.

And of course Alberta opted to release an RFP in early July. That RFP (SWP072021) was for work on modelling a child care subsidy for the Supporting Alberta Working Parents Advisory Group. Nothing in that RFP ensured that the federal conditions would be part of this modelling AND the works was not sue until September 2021. Now I saw this RFP because I subscribe to MERX. And, as a member of the federal Task Force for Women and the Economy, I advised the gang that the RFP had been issued and was a clear signal that a deal was in no way close to being complete.

Now I and a team of national experts on tax and ECE were going to bid on this RFP, but the terms that had to be accepted where highly problematic. Bidders had to waive moral rights, copy right, and sign an NDA. Collectively, this means that bidders are not only assigning the province the right to produce, reproduce, and publish the original work product, but the bidders must waive rights of attribution and association and right of integrity (moral rights). Waiving moral rights means not only can the Province not preserve the intent and original meaning of the work, the Province can also alter in any manner the work without the bidders permission. Bidders and their work can ultimately be referred to or used in a derogatory way, and can be used to threaten the Bidders reputation. The Proponent also has no say in attribution even if the work is represented in a way that threatens the Proponents reputation.

Here is my advice to the Government of Alberta. Parents in Alberta want you to make this deal. This deal will bring billions into the province that will help expand vital infrastructure to grow our economy. Making that deal allows for sufficient supply to be created, for ECE providers to have a better work environment, and support flexibility in terms of price, private and nonprofit supply, and even nonstandard hours provisions. It also frees up funds for Alberta to double down on demand side policies if they chose to do so. The notion that the province is being constrained in terms of flexibility is complete political spin. Yes, I realize this means that the province will have to eat crow, but given that this government is already tanking in the polls, it needs to do something to shore up some support. But leaving billions on the table is not how to do that.